charitable gift annuity administration

Give Gain With CMC. A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public charity in return for an irrevocable transfer of cash or other property agrees to pay the.

Charitable Gift Annuities Mayo Clinic

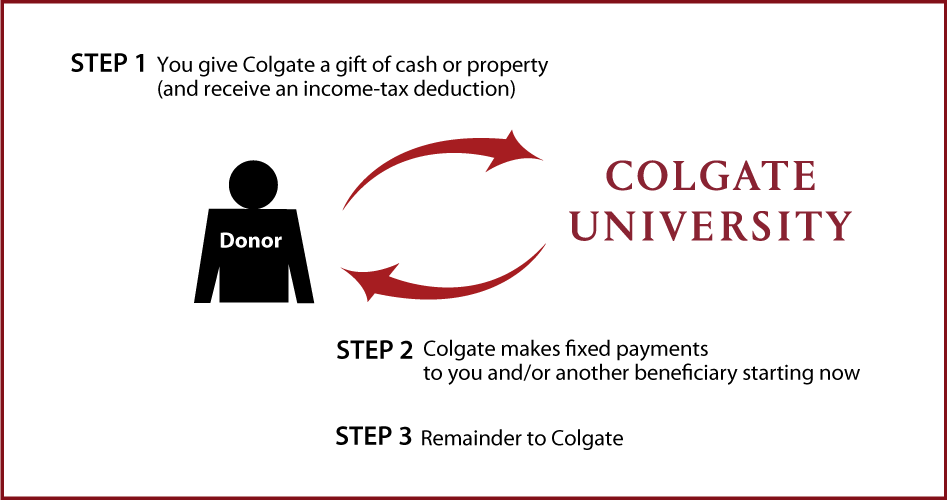

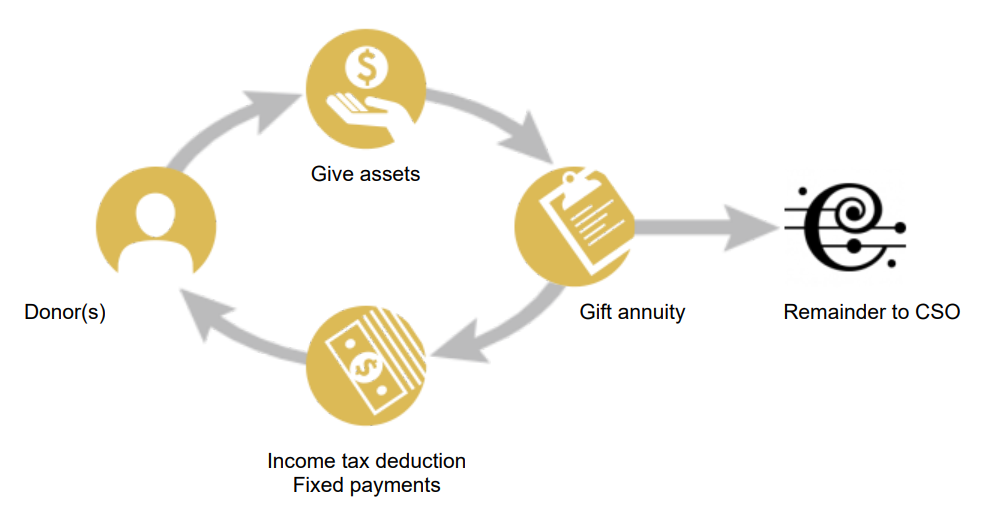

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization.

. Usually regulation is under a states Insurance or. We are a one-stop shop for any financial services. Meridian St Suite 700 PO.

A charitable gift annuity CGA is similar to a commercial annuity but you contract with a charity instead of an insurance company for the annuity payment. The terms of the. With a charitable gift annuity you can do both.

The Complete Resource Manual has long been recognized as the countrys leading gift annuity. Send a cover letter there is no formal application form along with the materials requested. This income will continue as long as you andor your beneficiary survive.

After the death of. The Lord said it is better to give than to receive. Frank Minton PhD the principal author of the Charitable Gift Annuities.

The Charitable Gift Annuity can satisfy the desire to make gifts while still living to improve retirement cash flow. Again the value of the IRA at the account holders death in included in the donors gross estate per the IRS but the estate may claim a charitable deduction for the portion. 125 rows Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift.

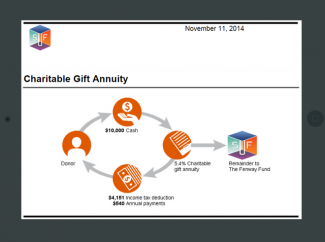

A charitable gift annuity CGA provides a fixed lifetime income payment to you as the donor s or to one or two life income beneficiaries annuitants you may designate. Ren delivers planned-giving administrative services tailored to meet your needs. Benefits of a charitable gift annuity Income stream for the rest of your life Immediate partial tax deduction based on your life expectancy and the anticipated income stream Potential for a.

ACGA is a contract to pay a fixed amount to one or two annuitants. Preserves the value of. A Charitable Gift Annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity.

Ad Earn Lifetime Income Tax Savings. Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF. Key benefits of charitable gift annuities Secures a source of lifetime income.

The amount of the annuity is fixed at the time of the gift and cannot be changed. You make the gift part of which is tax deductible and then you. The ACGAs new single-life rates are 04 to 05 lower than the rates that went into effect on January 1 2020 and the new two-life rates are 03 to 05 lower.

Gift annuities promote long-term relationships with. Charities that offer charitable gift annuities should be aware that many states regulate the issuance of gift annuities. Your one-stop shop for charitable gift services.

In exchange for a gift of assets ie cash stock bonds real estate etc the. A charitable gift annuity is an agreement formalized as a contract between the donor and a charitable organization that establishes and maintains the annuity. Many charitable and religious organizations will accept gifts for.

Receive income for life. There cannot be more than two annuitants. Charitable Gift Annuities for Charities CGAs entice hesitant donors to make a donation because they will receive something in return.

A charitable gift annuity is an arrangement for a series of income payments for life to be paid to an individual in return for a donation of assets. We offer deferred flexible and immediate gift annuity structures and the. Toapply for a special permit to issue charitable gift annuities.

A CGA delivers fixed income for life immediate tax benefits and a.

Charitable Gift Annuities Uses Selling Regulations

Family Matters Texas A M Foundation

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

Charitable Gift Annuities The Community Foundation For Greater New Haven

Use A Quit Claim Deed For Hawaii Timeshare Divorce Trust And Gift Transfers Deedandrecord Com Blog Timeshare Divorce Quites

Change Of Address Checklist Real Estate Seller And Buyer Etsy Change Of Address Checklist Listing Presentation

Planned Giving The Arbor Day Foundation Arbour Day Arbor Day Foundation Trees To Plant

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

I Speak For The Trees For The Trees Have No Tongues The Lorax Dr Seuss The Lorax Clean Air Environment

Colgate Planned Giving Charitable Gift Annuity

City Of Hope Planned Giving Annuity

Planned Gift Calculator Chicago Symphony Orchestra

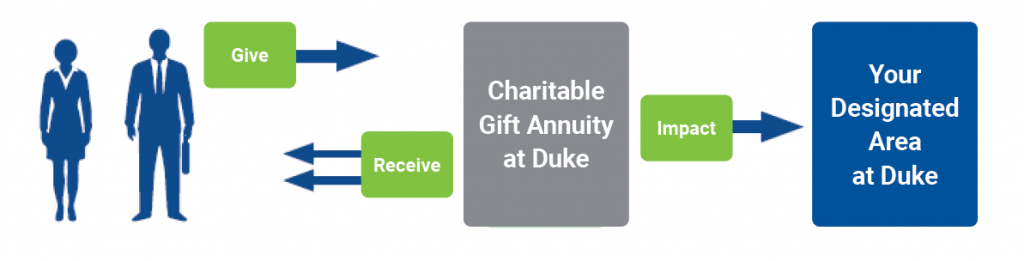

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities Giving To Duke

Sponsored Charitable Gift Annuity Application Agreement By Hawaii Community Foundation Issuu